pa inheritance tax family exemption

Pennsylvania has an Inheritance Tax that applies in general to transfers resulting. Who is entitled to claim the family exemption for inheritance tax.

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

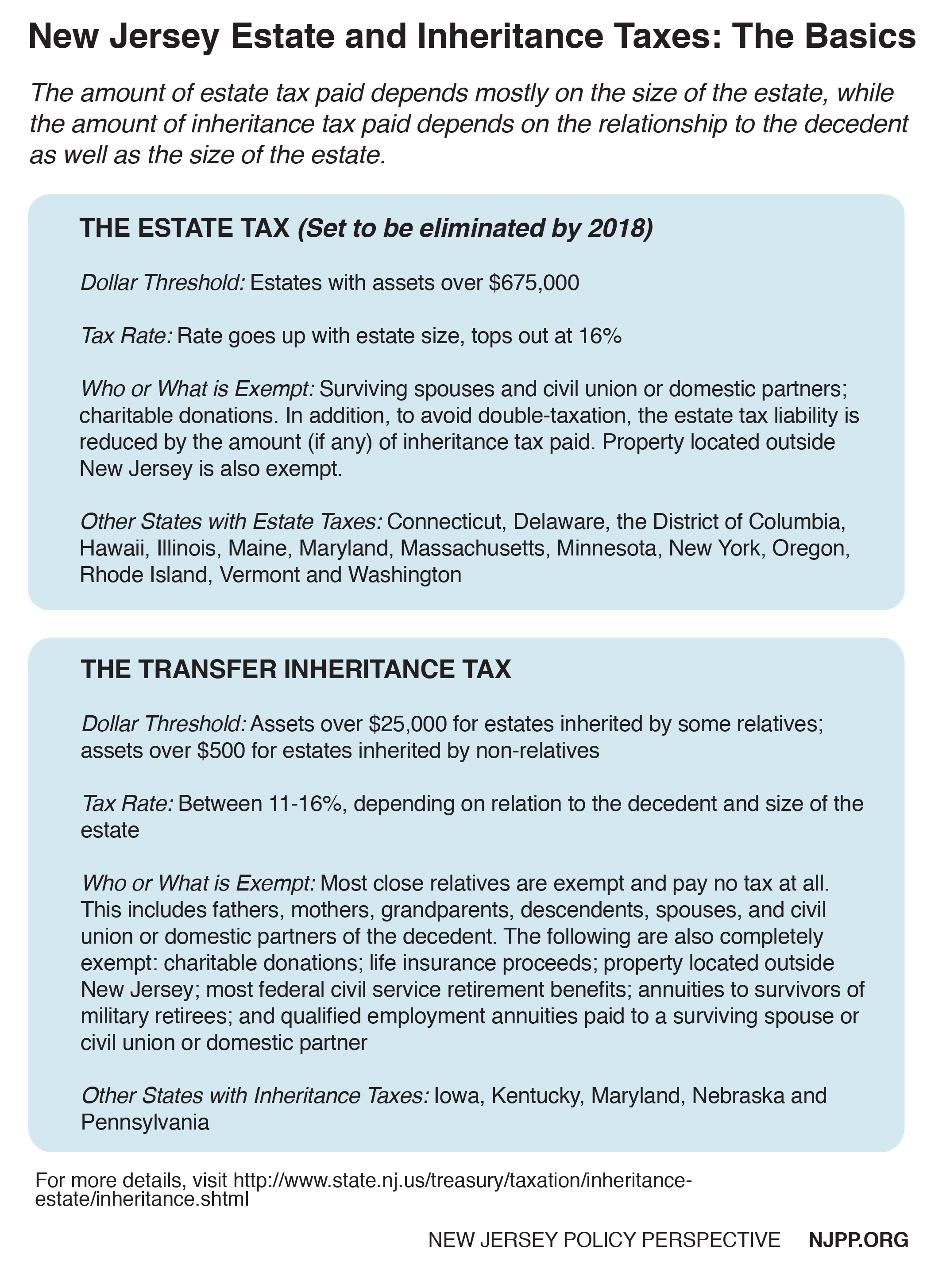

Inheritance Tax What It Is How It S Calculated Who Pays It

1 A transfer of a qualified family-owned.

. The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania. Effective July 1 2013 a small business exemption from inheritance tax is available for a transfer of a qualified family-owned business interest to one or more qualified. The family exemption is generally payable from the probate estate and in certain.

What is the inheritance tax rate in Pennsylvania. It is different from the other taxes which you might pay regularly. Client Review I worked for Peter.

Use this schedule to report a business interest for which you claim an exemption from inheritance tax. The family exemption is 3500. Act 52 adds Section 2111t to the Pennsylvania Tax Reform Code to exempt the following transfers at death from PA inheritance tax.

If there is no spouse or if the spouse has forfeited hisher rights then any child of the decedent. Qualifying for the Family-Owned Business Exemption from Pennsylvania Inheritance Tax. The transfer of your family-owned business to your family members may not be subject to any PA Inheritance Tax if it meets certain requirements.

Free Consultations 215-790-1095 Δ. Beginning July 1 2013 the transfer at death of certain family owned business. Act 85 of 2012 created two exemptions the business of agriculture 72 PS.

Pennsylvania Inheritance Tax Law Has New Exemption For Small Family Businesses. Secondly certain property is exempt from the tax altogether. However if your business.

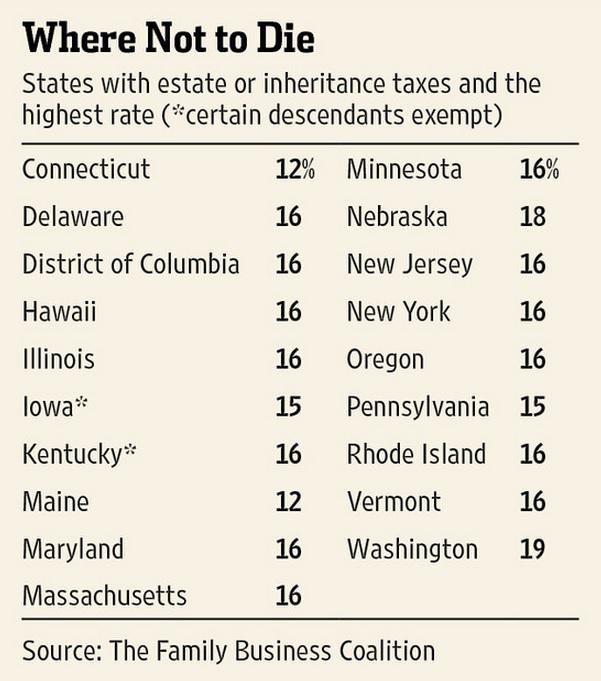

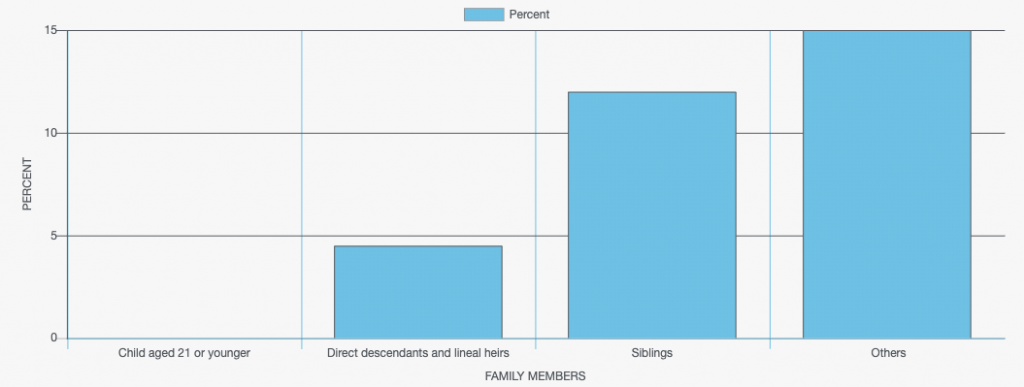

REV-1197 -- Schedule AU. REV-720 -- Inheritance Tax General Information. The tax rate for Pennsylvania Inheritance Tax is 45 percent for transfers to direct descendants lineal heirs 12 percent for transfers to siblings and 15 percent for transfers to other heirs.

Traditionally the Pennsylvania inheritance tax had a very. How many inheritance tax exemptions are available pursuant to Act 85 of 2012. Pennsylvania Inheritance Tax Safe Deposit Boxes.

To understand the significance of this most recent change its helpful to review the history of Pennsylvanias inheritance tax law. 45 percent on transfers to direct. To exempt inheritanc ny other a e statute d the broth estors and oing and t r legal ado ame family was claime of Revenue the seven f agricultur any year e been paid ents death tatepaus mily.

The surviving spouse does not pay a Pennsylvania inheritance tax. The Pennsylvania Inheritance Tax is a Transfer Tax. The Pa tax inheritance tax rates are as follows.

The most important exemption is for property that is owned jointly by a husband and wife. The family exemption is a right given to specific individuals to retain or claim certain types of a decedents property in accordance with Section 3121 of the Probate Estate. As the family exemption under the Probate Estates and Fiduciaries Code.

Charities and the government generally are exempt from. REV-714 -- Register of Wills Monthly Report. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger.

The family exemption is allowed against assets passed with or without a will. The rates for Pennsylvania inheritance tax are as follows. The Commonwealth of Pennsylvania created the Family Exemption to help the children or surviving spouse who lived with the deceased and relied on that persons assets or.

Therefore if you and your spouse own all. Under the qualified family-owned business exemption 72 PS. The rates for Pennsylvania inheritance.

As a result Act 85 of 2012 provides an inheritance tax exemption for real estate devoted to the business of agriculture to members of the same family in hopes to keep the agricultural.

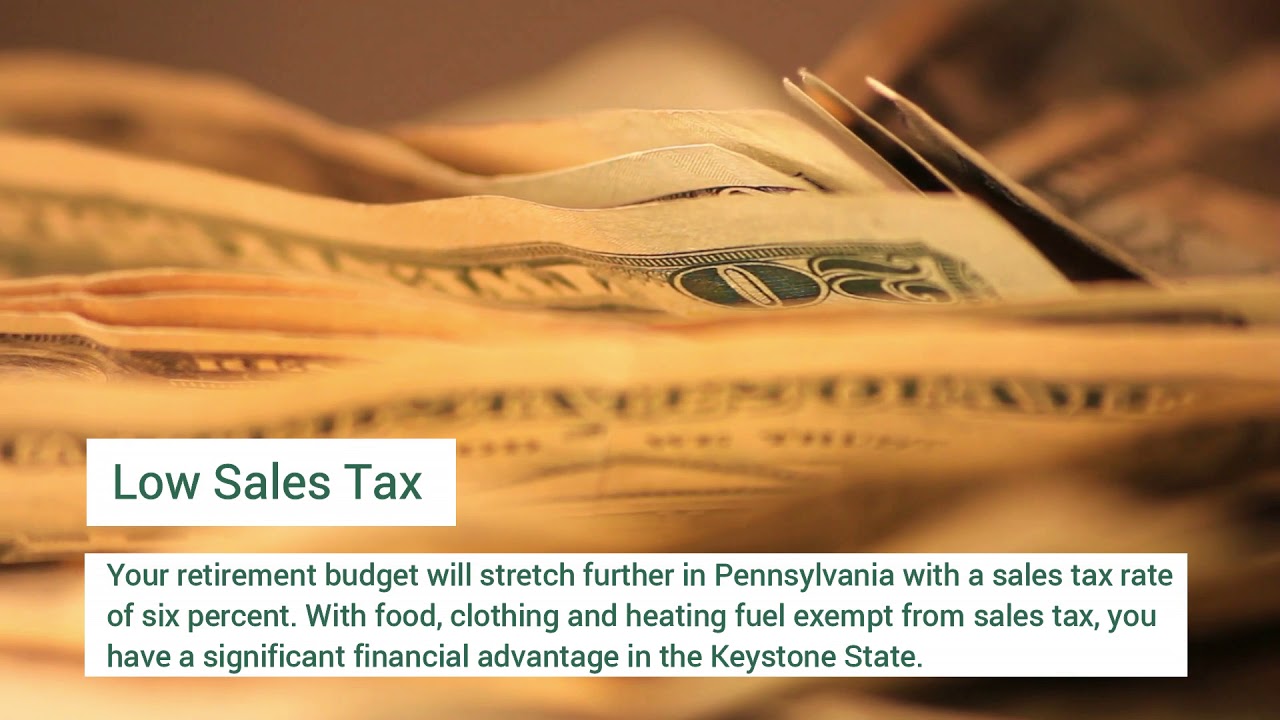

Why Retire In Pa Best Place To Retire Cornwall Manor

Inheritance Tax Attorney Snyder Wiles Pc

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Moved South But Still Taxed Up North

Fill Free Fillable Forms For The State Of Pennsylvania

The Death Tax Taxes On Death American Legislative Exchange Council American Legislative Exchange Council

New Change To Pennsylvania Inheritance Tax Law Takes Effect

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Pennsylvania Probate What Debts Take Priority

Settling An Estate In Pennsylvania

Pennsylvania Inheritance Tax And Other Factors When Inheriting A Home

Death And Taxes Nebraska S Inheritance Tax

What Are Inheritance Taxes Turbotax Tax Tips Videos

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

How To Close Or Settle An Estate In Pa The Martin Law Firm

Free Pennsylvania Small Estate Affidavit Pdf Eforms

Free Pennsylvania Small Estate Affidavit Pdf Eforms

March 4 2021 Trusts Estates Group News Key 2021 Wealth Transfer Tax Numbers

Pa Tax Exemption For Family Owned Businesses Supinka Supinka Pc

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning